By Air Max

•

January 19, 2026

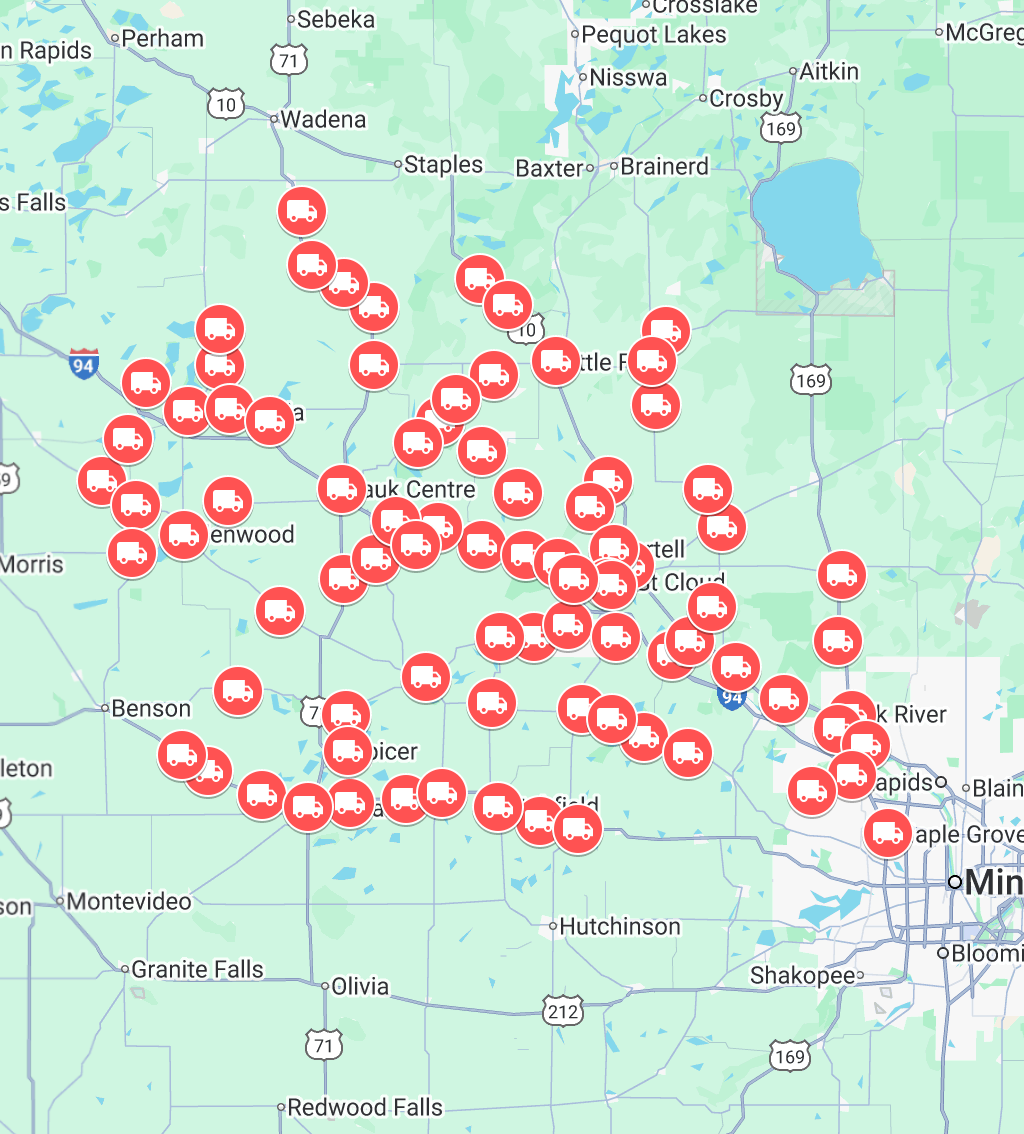

Why Your Furnace Keeps Turning On and Off (Short Cycling) in Winter If your furnace turns on, runs for only a few minutes, shuts off, and then starts again shortly after, that’s not normal—and it’s not efficient. This problem is called short cycling , and it’s one of the most common heating issues homeowners experience during cold Minnesota weather. Short cycling can make your home feel less comfortable, increase energy bills, and put extra wear and tear on your furnace. In some cases, it can even lead to a complete breakdown during the time you need heat the most. In this guide, Air Max explains what furnace short cycling is, why it happens, and when it’s time to call a professional. What Is Furnace Short Cycling? A healthy furnace cycle typically runs long enough to heat your home evenly before shutting off. Short cycling happens when the furnace shuts down before completing a full heating cycle—then restarts again soon after. Instead of delivering steady, consistent comfort, short cycling often causes: Uneven temperatures throughout the home Frequent thermostat adjustments Extra strain on furnace components Higher heating costs Common Causes of Furnace Short Cycling 1) Dirty Furnace Filter One of the most common causes of short cycling is a clogged air filter. When airflow is restricted, the furnace can overheat and shut down as a safety measure. What you can do: Replace your furnace filter Make sure return vents aren’t blocked Confirm supply vents are open If your filter gets dirty quickly, it may be a sign of airflow imbalance or indoor air quality issues. 2) Thermostat Problems A malfunctioning thermostat (or one installed in the wrong spot) can cause your furnace to cycle too frequently. Thermostat issues may include: Incorrect temperature readings Loose wiring Poor placement near drafts, windows, or heat sources A simple thermostat adjustment or upgrade can sometimes solve the issue. 3) Overheating Furnace If internal components overheat, your furnace may shut off early to protect itself. This can happen due to: Airflow restrictions Dirty burners Blower motor issues Heat exchanger problems Overheating should be taken seriously because it can lead to more costly repairs if ignored. 4) Improper Furnace Sizing A furnace that is too large for the home can heat the space too quickly, shut off, then restart repeatedly. While it may sound like “more power” is better, oversized systems often create: Temperature swings Noisy operation Less efficient heating Increased wear on parts Proper sizing is key for consistent comfort, especially during long winters. 5) Flame Sensor or Ignition Issues Your furnace relies on sensors to confirm safe operation. If a flame sensor is dirty or faulty, the furnace may shut down shortly after ignition. Common signs include: Furnace starts, then stops quickly Repeated attempts to restart Trouble staying lit This is a common repair and often inexpensive when caught early. Is Furnace Short Cycling an Emergency? Short cycling doesn’t always mean immediate danger—but it can quickly become serious if it’s caused by overheating, electrical issues, or a failing component. You should call for service if: Your furnace is cycling every few minutes Your home won’t stay warm You notice burning smells or unusual noises You see higher-than-usual heating bills The problem keeps getting worse The sooner you address it, the more likely it can be fixed with a simple adjustment or minor repair. How Air Max Fixes Furnace Short Cycling When Air Max inspects a short cycling furnace, we look at the full system—not just one part. This often includes checking: Furnace filter and airflow restrictions Thermostat operation and placement Safety sensors and ignition components Blower motor performance System sizing and ductwork balance Once the cause is identified, we recommend the most effective fix to restore reliable heat and protect your system. Stop Furnace Short Cycling with Help from Air Max If your furnace can’t stay running long enough to heat your home comfortably, don’t wait for a complete breakdown—especially during Minnesota winter weather. Air Max proudly serves homeowners throughout St. Cloud and Central Minnesota with furnace repair, maintenance, and heating performance solutions built for cold climates. Call (320) 441-7944 or use our online contact form to schedule service and keep your home warm, efficient, and reliable all winter long.